Get the free na form 14136

Show details

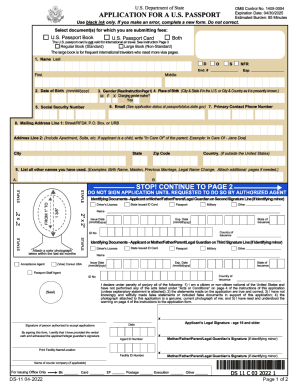

Ditch-digger Laborer Medical Officer HOMETOWN AT TIME OF EMP LOYMENT CAMP INFORMATION Location Company Number DATES OF SERVICE From To SECTION III REQUESTER IDENTITY AND CONTACT INFORMATION REQUESTER IS Former Civilian Conservation Corps employee identified in Section II Descendant of CCC employee specify relationship Other specify SEND INFORMATION/COPIES OF DOCUMENTS TO REQUESTER CONTACT INFORMATION Please print legibly or type Name Daytime Pho...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your na form 14136 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your na form 14136 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit na form 14136 online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit na form 14136. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

How to fill out na form 14136

How to fill out na form 14136:

01

Begin by obtaining a copy of na form 14136 from the relevant authority or website.

02

Carefully read the instructions provided on the form to ensure that you understand the requirements and necessary information.

03

Fill in your personal information accurately, including your name, contact details, and any other requested particulars.

04

Provide any requested details about your employment, such as your job title, employer's name, and address.

05

Include information about your income, including your gross monthly salary and any additional sources of income, if applicable.

06

Indicate any deductions that are applicable to you, such as taxes or contributions to retirement savings plans.

07

If needed, provide information about any dependents you may have, including their names and relationship to you.

08

Double-check all the information you have filled in to ensure accuracy and completeness.

09

Sign and date the form where required.

10

Submit the completed na form 14136 according to the instructions provided, whether by mail, in person, or through an online submission platform.

Who needs na form 14136:

01

Individuals who are required to report their income and employment information to a specific authority may need to fill out na form 14136.

02

Employers may also request their employees to complete this form to collect necessary information for tax or payroll purposes.

03

Individuals seeking to avail certain benefits or financial assistance programs may need to provide the information requested on na form 14136.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is na form 14136?

NA Form 14136 is a form used by the Department of Defense (DoD), specifically the National Security Agency (NSA), for the purpose of reporting potential unauthorized disclosures of classified information. This form is used to document the details of the suspected or alleged unauthorized disclosure, including the nature of the disclosure, individuals involved, and any other relevant information. It is an internal document used by the NSA to initiate the investigation and take appropriate actions to safeguard classified information.

Who is required to file na form 14136?

Form 14136 is required to be filed by individuals or entities who have failed to make timely payments or have outstanding tax debt owed to the Internal Revenue Service (IRS). This form is specifically used for filing a Request for Collection Due Process or Equivalent Hearing.

How to fill out na form 14136?

To fill out Form 14136, you can follow these steps:

1. Download the form: Visit the IRS website and search for “Form 14136.” Download the PDF version of the form.

2. Read the instructions: Before filling out the form, review the instructions provided with the form. Familiarize yourself with the purpose of the form and who should complete it.

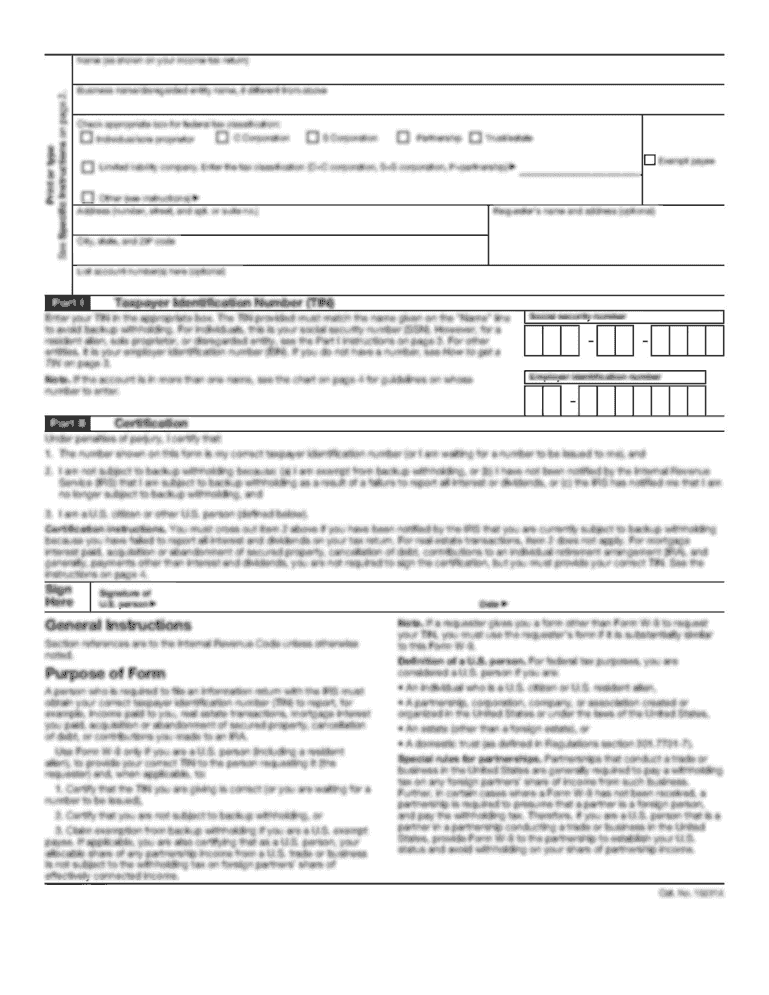

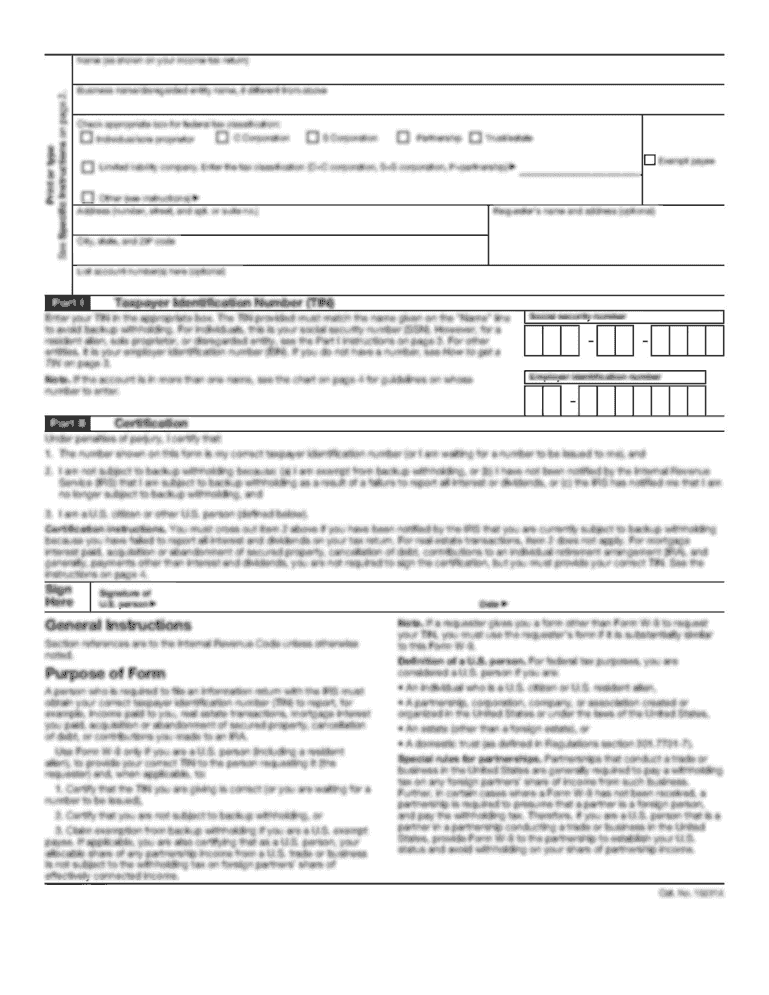

3. Provide personal information: Start by entering your personal information in Section 1. This may include your full name, social security number, date of birth, and contact information.

4. Provide business information (if applicable): If you are completing the form on behalf of a business or organization, provide the relevant business information in Section 1.

5. Identify the issue or concern: In Section 2, describe the issue or concern you want to report to the IRS. Be as specific and detailed as possible.

6. Provide additional information: In Section 3, provide any additional information that may assist the IRS in understanding your concerns. This may include supporting documents, dates, names, or any other relevant information.

7. Sign and date the form: In Section 4, sign and date the form to certify that the information provided is accurate.

8. Submit the form: Once you have completed the form, make a copy for your records and submit the completed form to the appropriate IRS office. The address for submission is provided in the instructions.

It's important to note that Form 14136 is used for reporting issues or concerns regarding abusive tax promotions or potential tax fraud. Ensure that your concerns fall within the scope of this form.

If you are unsure about how to fill out the form or have specific questions related to your situation, it is recommended to consult with a tax professional or contact the IRS for assistance.

What is the purpose of na form 14136?

Form 14136, also known as the User Fee for Offer in Compromise Application, is used by taxpayers who are applying for an offer in compromise (OIC) with the Internal Revenue Service (IRS). An OIC is a program that allows eligible taxpayers to settle their tax debt for less than the full amount owed.

The purpose of Form 14136 is to calculate and submit the required user fee associated with the OIC application. The user fee is a non-refundable payment that taxpayers need to include with their OIC application to process the request. The fee amount varies depending on the taxpayer's financial situation and the payment option selected. Form 14136 helps taxpayers determine the appropriate user fee to pay and provides instructions for making the payment.

In summary, the purpose of Form 14136 is to calculate and submit the user fee for an offer in compromise application with the IRS.

What information must be reported on na form 14136?

NA Form 14136, also known as the Report of Interview/Investigation, is used by law enforcement agencies to document and record the details, statements, and other relevant information gathered during an interview or investigation. The information that must be reported on NA Form 14136 includes:

1. Case Information: The case number, name of the investigating agency, the date and time of the interview/investigation, and the name of the interviewer.

2. Subject Information: Name, date of birth, Social Security number (if available), physical description, address, telephone number, and any other identifying information about the subject.

3. Witness Information: Names, addresses, and contact information of any witnesses present during the interview/investigation.

4. Incident Description: A detailed narrative or summary of the events that led to the interview/investigation, including date, time, location, and any relevant circumstances.

5. Interview/Investigation Details: A verbatim or summarized account of the statements made by the subject and any witnesses during the interview/investigation. This includes observations, explanations, admissions, denials, or any other relevant information obtained.

6. Evidence Collection: Any evidence collected during the interview/investigation, such as documents, photographs, videos, or any other physical or digital evidence. This should include a description of the evidence, the location of its storage, and any relevant chain of custody details.

7. Conclusions/Findings: Any conclusions or findings made by the interviewer/investigator based on the gathered information. This may include determining the credibility of statements, assessing the potential criminal implications, or any other relevant determinations.

8. Recommendations/Actions: Any recommendations or actions proposed as a result of the interview/investigation. This may include further investigation, arrests, charges, or any other appropriate steps to be taken.

It is important to note that the specific requirements for reporting on NA Form 14136 may vary depending on the jurisdiction or agency using the form. Therefore, it is always advisable to check with the specific agency or legal authority for any additional or specific reporting requirements.

What is the penalty for the late filing of na form 14136?

Unfortunately, I couldn't find specific information about a form with the designation "NA Form 14136" in any official resource. It's possible that this form may be specific to a certain organization or jurisdiction.

In general, the penalties for late filing of forms can vary depending on the nature of the form and the governing authority. Penalties might include late fees, interest charges, or other consequences determined by the relevant regulatory body or agency.

To obtain accurate information about the penalties associated with specific forms or situations, it is recommended to consult the instructions provided with the form itself or contact the organization or agency responsible for the form.

Where do I find na form 14136?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the na form 14136. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out na form 14136 using my mobile device?

Use the pdfFiller mobile app to fill out and sign na form 14136. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit na form 14136 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like na form 14136. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your na form 14136 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.